When you own one property with a significant amount of equity, there is often a way to use that equity to purchase a second (or third or fourth etc), and there are two main ways to go about doing this – cross collateralising and stand alone securities.

You can have a watch of this video Kirsty has made that steps through how this all works, and also see the examples below:

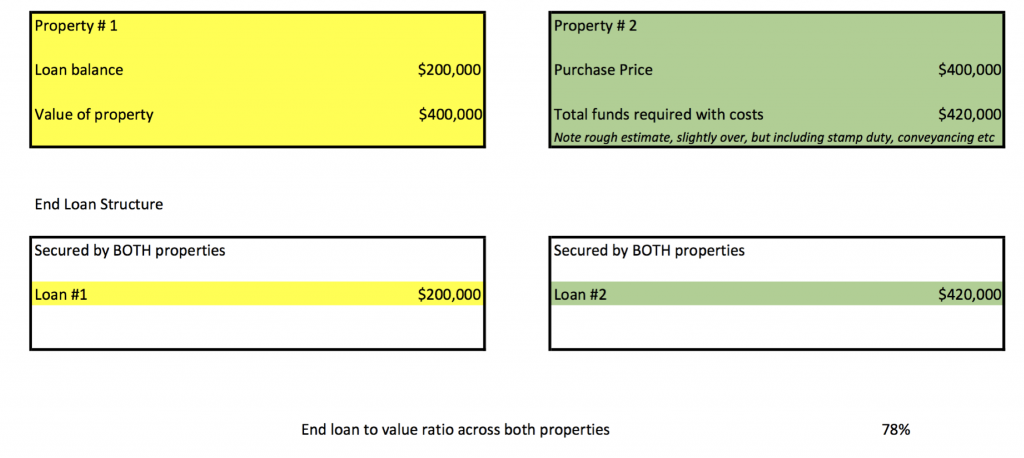

Cross collateralising

This can often seem like the most simple solution and it is very commonly the strategy put forward by banks. You use the overall value in both properties to give you two loans at the end. One for your existing property, one for your new property.

It might look something like this:

Two end loans, loan to value ratio across both properties lower than 80% so no lender’s mortgage insurance (read: https://www.uploans.com.au/blog/2017/08/20/what-is-lenders-mortgage-insurance/) and a nice easy way to look at your internet banking.

There are times when we will recommend this structure but only if there is a significant benefit to the client (such as dramatically reduced interest rates etc).

Most times however, the negatives to this type of structure far outweigh the positives and typically these aren’t apparent up front. They become very clear however when you go to sell one of the properties or need to move it to another lender, or need to restructure and the bank has security across both of them. For starters, the value of both properties may need to be assessed meaning potential cost and also the potential that one of the properties may have gone down in value. I’ve seen clients who have had to pay many thousands of dollars in valuation costs (due to a cross collateralised commercial property) and others who have been unable to sell one property they really wanted to due to a low valuation meaning they weren’t able to sustain the bank’s equity requirements once sold.

There is however another alternative.

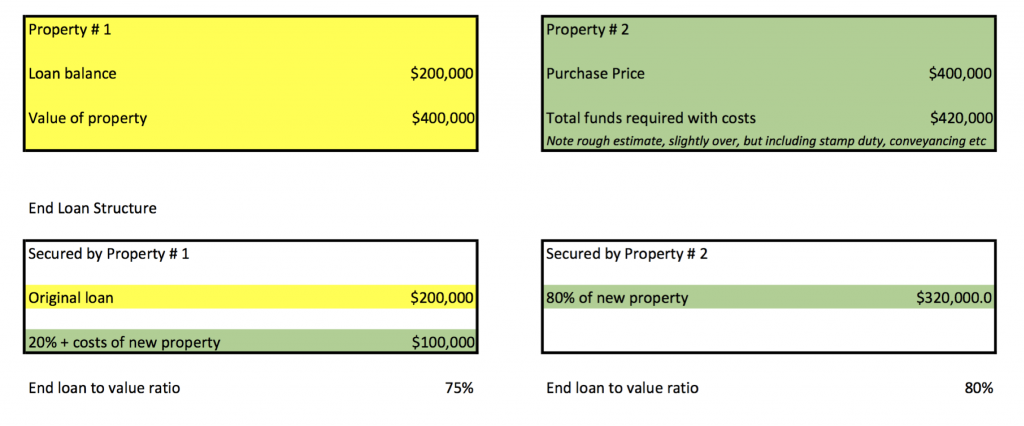

Stand-alone securities

Now, the same deal as above would look something like this if the properties were not cross collateralised.

On face value, this is harder to understand and looks a little more complicated. We now have 3 loans whereas previously we only had two, but there are some real benefits:

a) Each property is stand-alone – ie: not dependent upon the other

b) The overall loan to value ratio is still at or under 80% on both properties

c) If one of the properties is rented, all debt for that property is still kept separate so tax deductibility is preserved

d) And if one property is sold, the loans secured by that property only should need to be discharged (for example, if property #1 is sold, the $200,000 and $100,000 loans need to be paid out, and the value of property #2 should not come into question).

Now every situation is different and the above is a simplistic example. Sometimes you don’t have enough equity to keep both properties at 80% and one may need to be higher than that and incur lender’s mortgage insurance but one can be kept at 80% for example. There a lots of different situations and yours needs individual analysis.

Talk to your broker, work on a plan and hopefully the above blog helps explain the concept a little clearer.