You betcha! If potatoes can become vodka (or gnocchi, or fries from the land of France), and cauliflower can become pizza, and caterpillars become butterflies, tadpoles become frogs, these tiny slugs (see below) can become giant pandas and a chameleon can pretty much become anything – you my friend can become a home owner.

I think it’s best to start an article on savings in the words of the world’s greatest investor Warren Buffet “Don’t save what is left after spending; spend what is left after saving.”

Fun facts about Warren: despite being one of the richest humans on the planet, he’s lived in the same house since 1958 and he drives a car that cost around $45,000 USD. In short, one of the richest humans on the planet (and most philanthropic in his later years) still understands the power of being frugal and sensible.

Tip 1: Save first, then spend

So let’s start there with the first cardinal sin of saving – to live first and then try and save what’s left over. It’s like moving into a house with cupboard space galore and saying “we’ll never fill those” – you will!! And if you try to save what’s left after you live, you’ll fall short of your savings potential every time.

So: start with a budget, map out what you need to live on, leave a little extra for emergencies and figure out what you should be able to put aside for savings EVERY pay. Save first, spend later.

I say it time and time again every day, but what you don’t see, you’re less likely to spend, so put your savings in another bank account that you don’t have an EFTPOS card to and that does not show up on your day to day banking (a whole separate bank is great, do a shop around for interest rates – ME, ING, Ubank all tend to have great rates – well as great as you can get given interest rates are so low right now). The key point is, save first, then spend what’s left.

Tip 2: Budget

If the word budget makes you break out in a cold sweat – you’re not alone. Most people don’t budget, and if they do, they never refer back to it.

Start off by trying to estimate what you spend. We’re happy to send you our living expenses estimator which is a great place to start and you can put in estimates for spending. If you don’t already have one just email us: hello (at) uploans.com.au and request one. You can also have a look here to see how to complete our living expenses calculator for budgeting purposes.

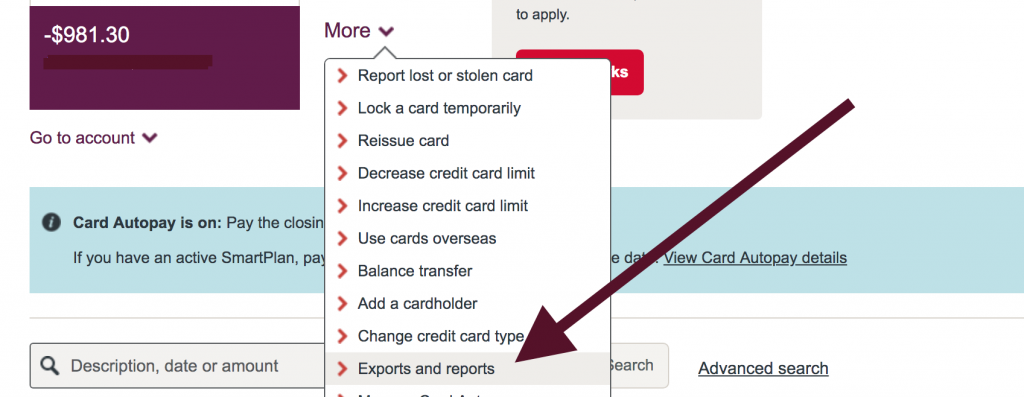

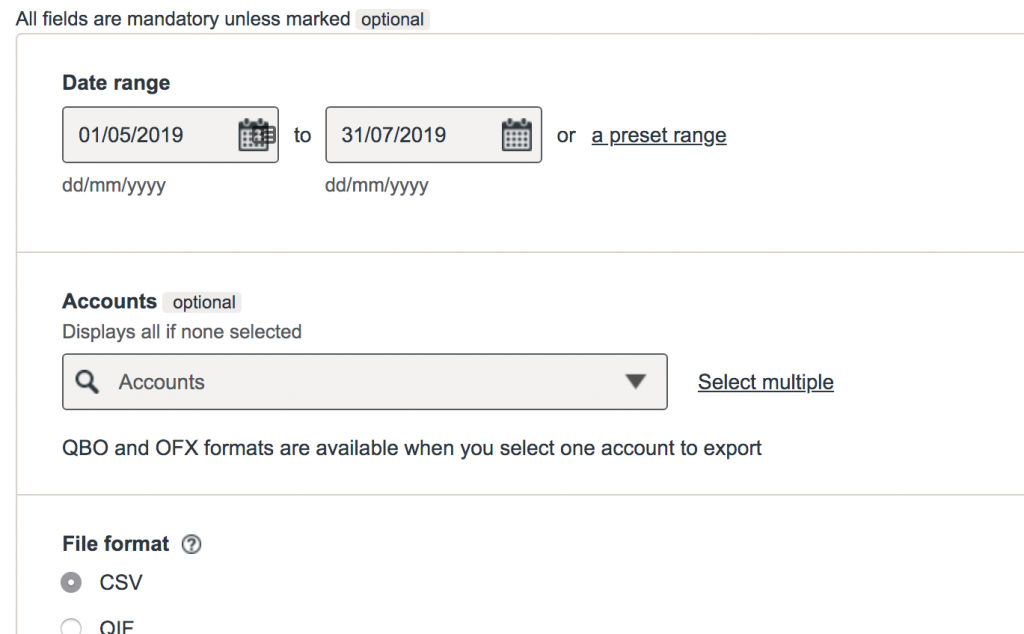

Then, it’s time to check what you ACTUALLY spend! The easiest way to start is to download a CSV statement of all your accounts and credit cards for the past 3 months. Most banks will allow you to do this, here’s a little snapshot of how I just did it on Westpac:

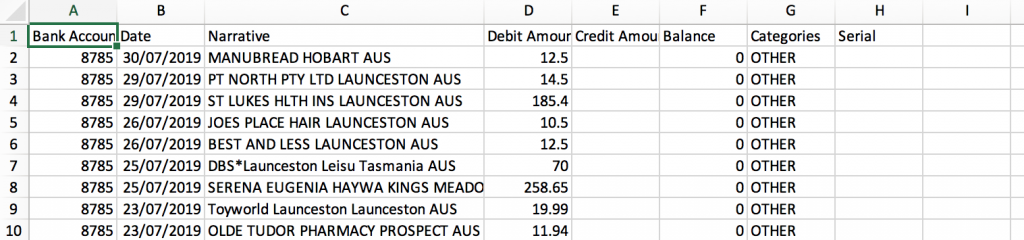

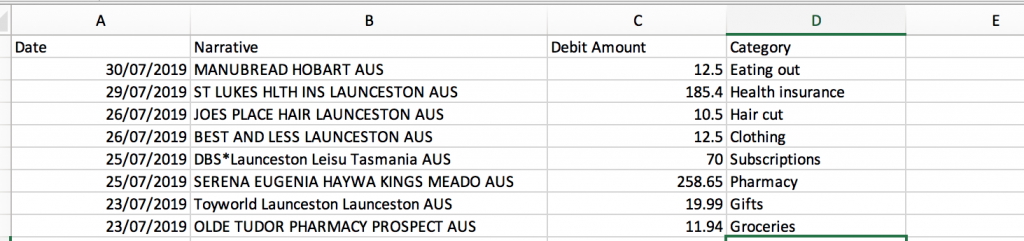

And then you end up with a CSV file which you can open in excel or google sheets or a similar program which will look like this (important get one for EVERY account you operate from).

From there, get rid of any columns you don’t need (I usually just keep date, narrative ie what it’s for, and debit amount) and start to categorise EVERYTHING you’ve spent in the past 3 months.

Importantly – once you start changing this file, copy it to another spreadsheet or save it in an .xls format so you can keep editing it as sometimes CSV files can be a bit limiting.

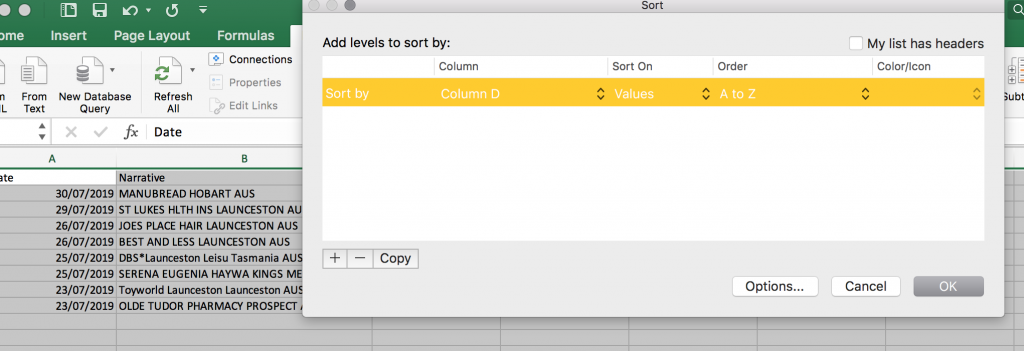

Once you’ve categorised everything (you might even get excited like me and colour code it) go to (in excel) Data / Sort and then sort it by your “category” column. And then, add up what you actually spent for each category vs what you estimated in your budget.

Unless you’re superhuman there will be areas in which you spend significantly more than you’ve estimated (hello take away coffee!)

Next step is to try and plug those gaps. Update your budget where you’ve legitimately missed something you need, but otherwise, figure out where your savings is going and quit it!

Take out the savings first, spend only what is left and leave your savings alone!

And most importantly, each month, download your CSV and examine how close you were to budget and if there are any other gaps that need plugging. Handy hint – the bank is going to want to look at your last 3 month’s statements before you go to put in a home loan application so it’s best if you look at it first!

Tip 3: Extras

Got a payrise? Awesome, you lived on it perfectly well before now, put it all into your savings.

Bonus or commission? Same thing: you were living perfectly well on your base, avoid the temptation to celebrate by spending your bonus, you should have some entertainment money in your regular budget, use that and save your bonus.

Not saving fast enough? So many hospitality industries / awards and function centres need casual staff for fill ins at their busy time,

Tax return? You know what I’m going to say don’t you!

Christmas presents? Rather than nanna buying you another pair of socks, why not let them know you’re saving for a house and would much rather the $20 towards that.

If you’re awesome you might even have extra money left over at the end of the pay period, if so, great, add it into the savings!

Sounds boring right? Let me tell you, you won’t think it’s boring when you walk through the door to your new home.

Tip 4: The Spend Free Day

Try to have one day a week where you spend nothing. Zero. No petrol, no paying bills, no take away coffee, no muffin, no buying Mum a birthday card, nada, zero, zip, zilch.

It’s harder than it sounds! Give it a go.

And because I’m meme central today in this article I’m just going to leave you with this. You’ve got this. You’re worth it and you can do it.

Kirsty