There are two main types of valuations:

Onsite valuations.

Onsite – where a valuer will go to the property to inspect the property.

(click here for a little article on what to expect from the valuer when they perform their onsite inspection.)

Type 1.

Where there is a contract of sale.

Usually you’re purchasing a property from someone who is not a relative. You might be using a real estate agent or dealing directly with the seller, but you’ve signed a contract to purchase a property.

A valuer is then randomly assigned by the bank your broker has chosen. Note, it’s not the bank who does the valuation it’s an independent valuer.

Most of the time the valuer will assign the same value to the property as you’ve paid (which is just what you want to see)

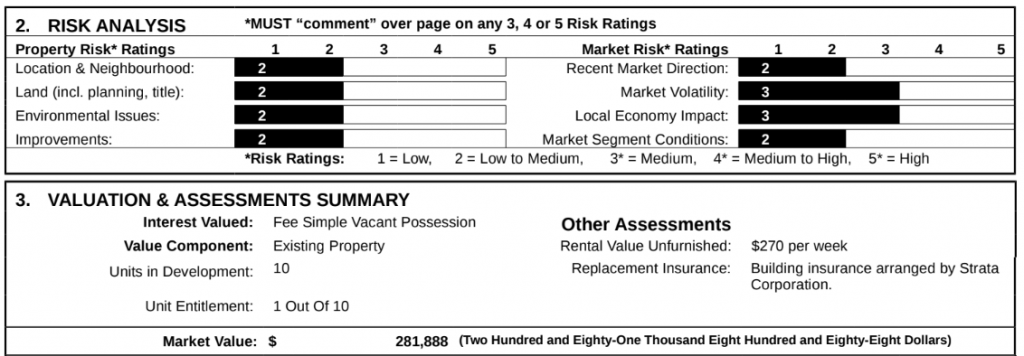

See below where the valuer has said that the property is worth $281,888 – weird number right? That’s because it’s exactly the same as what is on the contract of sale and the valuer is just agreeing that they believe this to be fair market value. Had the value been $282,000 for example, then in all likelihood the valuation report would have given that value to the property.

In this case all risk ratings are below 3 as well which is great and that’s a good sign that the valuation should be acceptable to the lender.

See below, the valuer will also identify other properties on the valuation report to show the bank how they’ve ascertained that the property is worth what is on the contract. If they cannot find enough to meet the bank’s metrics as far as settled sales in a certain radius within a certain time frame that may also impact on the value they can provide.

Type 2.

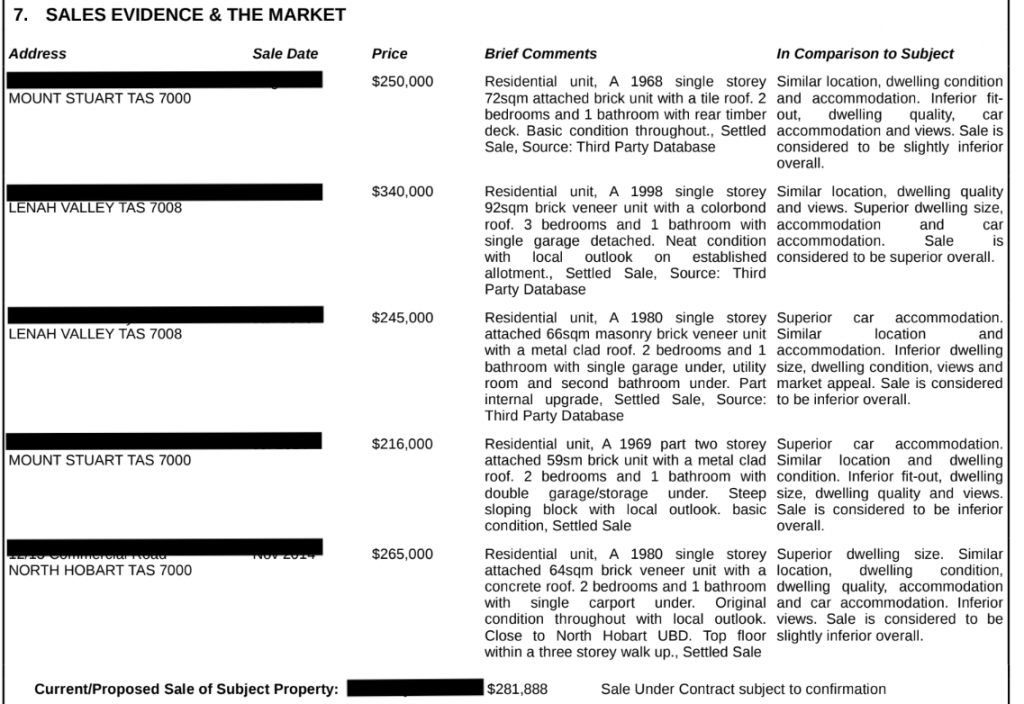

Where you’re buying from a family member and have a contract of sale.

If the contract clearly states you are buying from a family member (see one example below, we recommend your solicitor or conveyancer draft this clause) the valuer then has scope to assess what they believe the believe the actual value of the property is. In the case of one recent related party transaction we did the contract value was $280,000 but the valuer said they thought the value was $320,000.

See: https://www.uploans.com.au/blog/2018/06/25/favourable-purchase/for more information

Type 3.

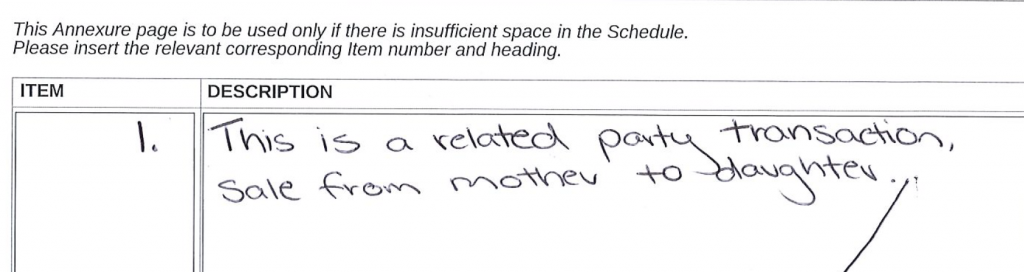

Where there is a building contract + plans + inclusions to assist the valuer in determining the value.

The outcome you are hoping for here is for the valuation to be at least land cost + build cost.

On the example below, the land cost $145,000 and their build cost $229,897 and the builder assigned an end value of $375,000 – just what we’d hoped for here.

Automated valuations.

Where the bank does not require a valuer to go to the property to inspect the home.

Each bank has different requirements for where they will and will not require a valuation to be done.

Typically if you’re borrowing more than 80% of a property’s value a bank will require an onsite inspection.

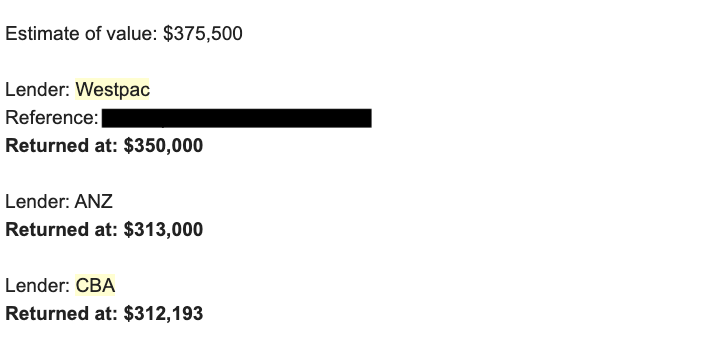

There are times when you’re borrowing under this amount where a bank will allow you to use their automated system to get a valuation figure. Each bank’s system may give a different figure (see below example of 3 recent valuations my team ran for me on the same property).

These valuations are sometimes used when you have a contract of sale and sometimes used when you are refinancing a property. If you meet the bank’s policy and time frames an onsite valuation may not be required.