When it comes to debt, the unfortunately reality is – the worse it is for you, usually the easier it is to get!

Credit cards, interest free, afterpay, zip pay, personal loans – all typically quite easy to get, all used to buy things which go down in value and they all can impact your ability to get a home loan and your credit score.

Things to be aware of:

Afterpay, Zip pay, Zip money

A lender will factor this in as an ongoing liability, it will impact your borrowing capacity and the better you are at repaying your Afterpay the higher your limit will be. Oftentimes there is no set limit which makes it very hard for a lender to properly assess this. In addition there is the “Afterpay effect” ie: the very real reality that you’re likely to spend more because your brain doesn’t see that the boots cost $200 – it sees only the $50 (and ignores the “times 4 payments” part).

Our usual recommendation is to email Afterpay, close your facility and email us confirmation of this closure.

Interest free cards (ie: GE Creditline, Harvey Norman GO cards etc)

There are 3 main reasons why these cards impact:

- People see “interest free” on these and forget that it doesn’t mean “fee free”. Let’s take the obligatory monthly fees of $2.95 + $4.50 on a GE Creditline card. On a $1200 balance that $89.40 per year is equivalent to a 7.45% interest charge, on a balance of $500 it’s 17.88%! (Translation, if it’s a low balance, pay it out and close it!)

- The limits of these cards are usually really high and banks assess your debt based on the limit of the facility not the amount you owe. A $20,000 limit for example can strip $9,000 of your income a year according to how the banks can look at these cards.

- Requesting limit drops and closure letters from these providers can be notoriously slow – as in 10 + days. That’s a lot of time to be waiting if you need that confirmation to show a bank before they’ll approve a home loan if you have finance to confirm (and not the bank just won’t take your word to say you’re going to close or drop limits).

Credit cards

Here’s the things to remember here:

- You don’t need to have a credit card or even a credit history to get a home loan.

- Having multiple credit cards means multiple annual fees and multiple hits on your credit report.

- Banks can now see the conduct of your credit facilities going back 2 years (so that late payment in October of 2 years ago may well come back to bite you).

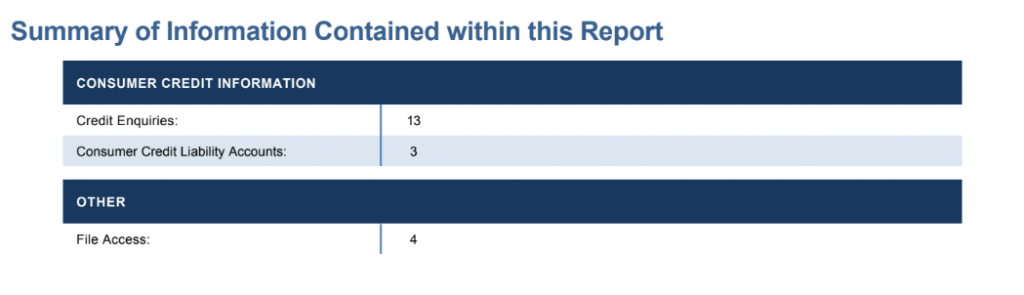

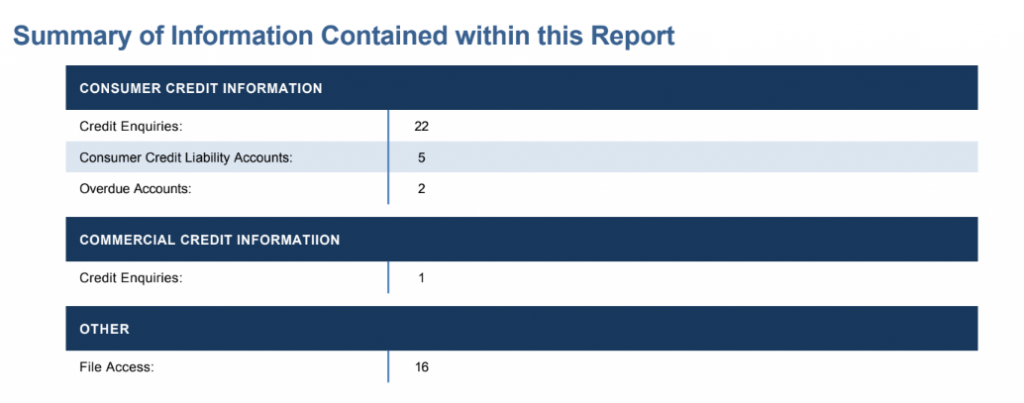

- People think they’re playing the system by shopping around for the best points options all the time, but what they’re really doing is lighting up their credit report like a Christmas tree and potentially impacting their ability to get a home loan. (see below examples showing how your credit report may look if you start to have a lot of activity)

Where possible remember that simple is best. As few credit facilities as possible, repayments on time and at least as per minimum requirements and if you have a credit facility that you do not need, close it down and request a closure letter.

Kirsty