A lot of our day is spent working through comparisons for our clients about whether to stay with their current lender or move to a new lender. Here is an example of what we do, at no cost to you.

Our clients, let’s call them Jane and Jack are with Lender A, Lender A has them on a 3.5% interest rate and won’t renegotiate their interest rate for them down to a lower rate. Jack and Jane owe $350,000 and their home is valued at $500,000.

We’ve attached two scenarios:

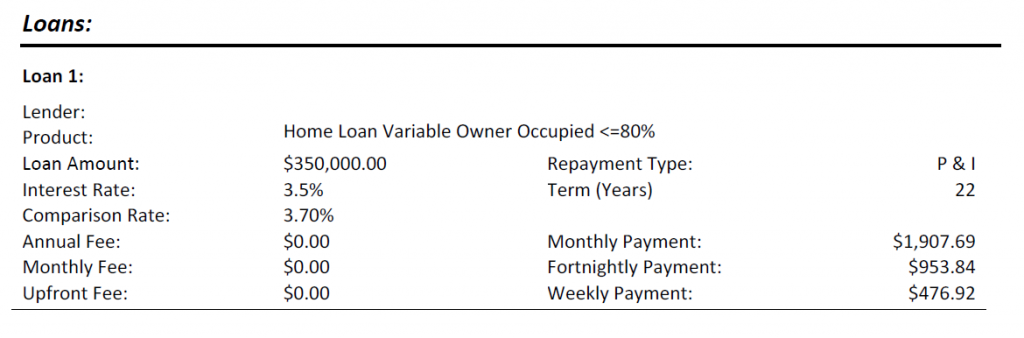

Lender A – (Jane and Jack’s current bank) on a basic product with $350,000 owing at 3.5% variable interest rate, 22 years remaining.

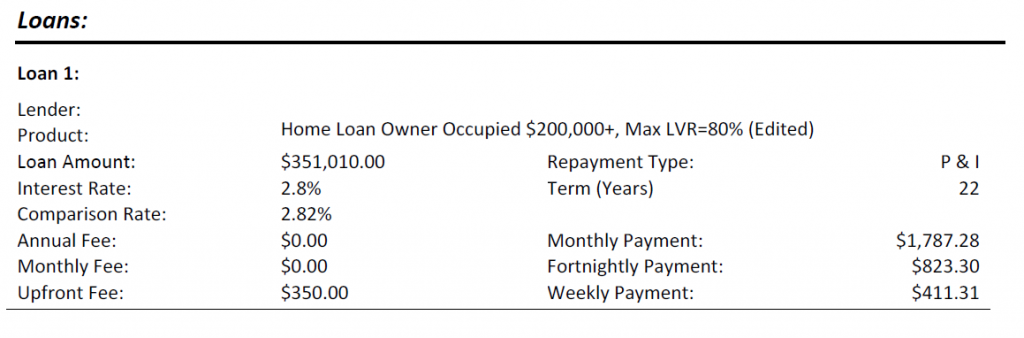

Lender B – A loan of $351,010 (it cost $1,010 to switch with this bank and for this example we won’t include any cash back from a lender to cover costs) at 2.8% with no monthly fees and the same 22 years remaining.

The difference is $130.54 a fortnight! Over a year that’s a huge $3,394.04 Over 5 years that’s over $16,000!

** This is general advice only. We’d love to catch up and chat if you think we can change your numbers for the better and if you’re awesome where you are, we’ll tell you that too **